"Whether in commerce, science, or politics—history remembers the artists." — Naval Ravikant

—

—

I recently dove down the rabbit hole, seeking answers for the obvious question: why are JPEGs selling for millions?

There had to be more to the story (because of course there is). So I inhaled as much information as possible on the exploding digital frontier, and emerged wide-eyed, with a new perspective. Admittedly, I have only scratched the surface of what feels like a glacier. I claim no expertise (few at this stage can); only a burning curiosity. There is still a long way to go. But I can see the path now. And according to a booming legion of fervent believers, it’s more akin to a launchpad.

One of the biggest roadblocks facing the NFT world right now is a lack of understanding. With news surging, oversimplification is in high demand. Yet there’s not a lot of great introductory material out there if you’re just stepping into the fray. My goal is to break down the broad concepts in layman’s terms so more people have a chance to grasp the magnitude of what’s actually happening here. Let’s get started.

WEB 3.0

Before we get to the million-dollar jpegs, we need to reflect on the state of the internet.

What began in a big-bang of clunky dial-up, dotcoms, and desktops, eventually evolved to the iPhone, high-speed wifi, the cloud, Netflix, Spotify, Amazon, and the total transcendence of social media. The problem, though, as we’ve had to learn the hard way, is that what started as a hopeful means of connection grew closer to a cage of division. Zuckerberg mined our behavioral data like a hoodie-wearing Rockefeller drilling for oil. And he wasn’t the only one. Rage clicks and vanity metrics became the norm, fueling insecurity and unparalleled returns on ad spend. And as we were being productized, the internet hit puberty and turned into a brooding teenage version of itself. Luckily, the next major upgrade, better known as Web3, is here, and it’s going to guide the teenager into adulthood.

Web3 is a more intelligent version of the internet, built on the principle of decentralization. If you’re not familiar with decentralization, try thinking of it simply as the ability of a group to function without reliance on a central authority. Banks, governments, and businesses are all examples of centralized entities. At the core of decentralization is a push toward individual freedom. Not freedom to, but freedom from. The distinction is important.

Part of why the crypto movement has garnered so much enthusiasm is because decentralization is viewed by many as a form of resistance against oppression. The extent of how centralized some institutions should remain in the future is a messy debate that we’ll save for another day. Famous examples of decentralization in history include The Declaration of Independence (decentralized political power from a ruling monarch); the printing press (decentralized access to information previously controlled by the church); the internet (decentralized access to collective global knowledge). Now, using blockchain technologies like Bitcoin and Ethereum, we’re ready to take things a step further. The teenager goes to college.

@visualizevalue by @jackbutcher

@visualizevalue by @jackbutcher

Okay, but what’s a blockchain, and how does it work?

Good question. Essentially, a blockchain is a digital record of transactions that is duplicated and distributed across a peer-to-peer network. This means that once a ‘transaction’ is final, it is on record and irrefutable for every participant within that network, forever. As the network expands, so do the trusted blocks, which compound the security. The digital record of transactions, also known as a ledger, is decentralized. The power of verification is embedded within the group. No central authority is needed to legitimize a transaction. Part of the beauty of Bitcoin is that you can transfer unlimited amounts of money across borders without worrying about Western Union fleecing you on the way out. This is especially powerful for citizens of developing countries, and immigrant families, who rely on money transferred across continents.

Blockchains are categorically open (they are built from open-source software and executed in full view of the world); trustless (meaning the network allows participants to interact publicly or privately without a trusted third party); and permissionless (anyone, both users and suppliers, can participate without authorization from a governing body). (*helpful explanation video)

That last paragraph was a mouthful. Just know that the implications are massive. Blockchain technology will be used in the future for tracking medical records, real estate deeds, tax integrity, statements of work, and even elections. The potential use cases are limitless. For Web3, blockchains represent digital sovereignty. An ability to own and mobilize your online identity. A chance to connect, create, and do business with others, outside the boundaries of a platform. And the opportunity to evolve your identity.

METAVERSE

For the last 20 years, gamers have exchanged cash for digital goods, helping construct alternate identities in the process. Think Fortnight “skins”, invitations to premium dating apps, and Reddit “gold”. As the term “metaverse” percolates, so has the idea that the internet will someday resemble an omnipresent video game, playable for all. If you’re thinking “this sounds like Ready Player One”, that’s because it does. Momentum has long been brewing for commodities built for the virtual world. And the steam is picking up.

*Not Boring’s Packy McCormick expands on this idea in his wonderful essay, The Great Online Game:

If you’re still with me but think this all sounds ridiculous, try meditating on the following: what makes a blue checkmark on Instagram desirable? What does it signify, really? And if one could be purchased, what would it go for?

NFTs

An NFT, or a non-fungible token, is a way of representing ownership in the digital world. “Non-fungible” is a weird-sounding word. But it is worth understanding. In economics, fungibility is the characteristic of goods or commodities where each unit is interchangeable and indistinguishable from the other. For example, a five-dollar bill is fungible because it can be swapped for a different five-dollar bill while retaining the same value. So are public stocks. Conversely, an original artwork, let’s say a Winslow Homer painting from 1899, is non-fungible. Sure, copies can be made, but only the original is worth the big bucks. Hordes of wealthy art collectors keep their originals locked away and protected in Swiss vaults, adorning their walls with duplicates so their guests won’t forget. Museums do this at times when an original piece is in need of restoration. Can you blame them?

Since the dawn of civilization, humans have collected and bestowed value on items deemed rare: shells, gems, spices, coins, stamps, wine, and pokemon cards. All are NFTs from bygone eras. As technology evolves, so does the way we signal value to one another (despite how absurd it may seem). Seeking social capital is hardwired into our DNA. NFTs are just the next version of this, and we’re starting to see why.

So how does an NFT work?

Unlike Pokemon cards, fine art, and rare wine, the authenticity of an NFT can be verified instantly and unequivocally thanks to the blockchain it was created on. When you purchase an NFT, you receive a “token” of digital originality that cannot be disputed. This is due to the unique properties stored within the token’s metadata, like a software fingerprint. The number of tokens for a given NFT can be verified on the blockchain, making it instantly provable. You cannot buy or transfer a fraction of your NFT, even if you wanted to. You can only transfer the original as it was purchased. This guarantees full ownership of the asset. The history of ownership, as well as the asset’s record of value, can always be accessed, making it hyper-resistant to fraud. *(helpful explanation video)

The virtual world is quickly expanding, and with it will come unending opportunities and means of personal expression. New stories, businesses, careers, forms of entertainment, and communities will spawn like mushrooms. Consumerism will evolve before our eyes. Brands have, and will, enter the space, failing and succeeding spectacularly along the way. And it is all beginning -- as most pivotal movements in human progress do -- with Art.

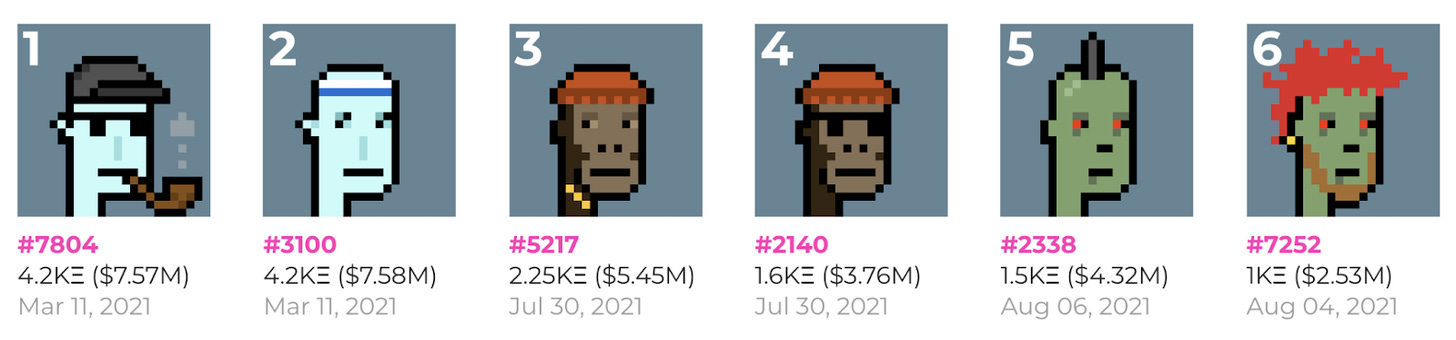

CryptoPunks and Bored Apes

Enter CryptoPunks. If you’re anywhere near the space on Twitter, you have probably seen these 8-bit renderings popping up as in-vogue avatars for industry shakers like Jay-Z, Gary Vaynerchuk, Steve Aoki, and Logan Paul (ugh). For the most part, though, they are purchased and adopted by an army of pseudonymous accounts that sling cryptic acronyms faster than they can welcome new followers.

So what’s going on here? The project, which launched in 2017, generated 10,000 characters -- with varying hairstyles, hats, and attire -- to be hosted on the very early Ethereum blockchain (Note: although there are other blockchains, most NFTs, including the ones we’ll cover, are bought on the Ethereum blockchain.) While the creators had some control curating the elements, the ‘punks’ were mainly left to the generator. In the world of NFTs, the project is considered ancient -- like a cave painting of blockchain art. Punk#7804, which sold for $7.5 million in March, has been called the Mona Lisa of digital art. Dylan Field, the CEO of design software startup Figma, who sold the Punk, waxed philosophical on the contemporary art comparisons:

I think the "What is art?" question for CryptoPunks is super fascinating, because there's all these different ways to break it down. There's the algorithm of how punks were generated in the first place: They had this algorithm that would remix all these different characteristics infinitely, and they took a random sampling of 10,000 of the different images that came up. They could have had millions. This is a random collection of the universe of punks. So maybe that's the art.

Then there's individual punks as well, like 7804. And that seems to be art, too, in terms of the individual piece of art. But what I've come around to is the belief that the community itself is the art piece. The market, the discussions that are being had, the community that's forming. It really does care so much about the project and is loving it into existence. That is the art piece itself, these interactions were all happening around the punks ecosystem.

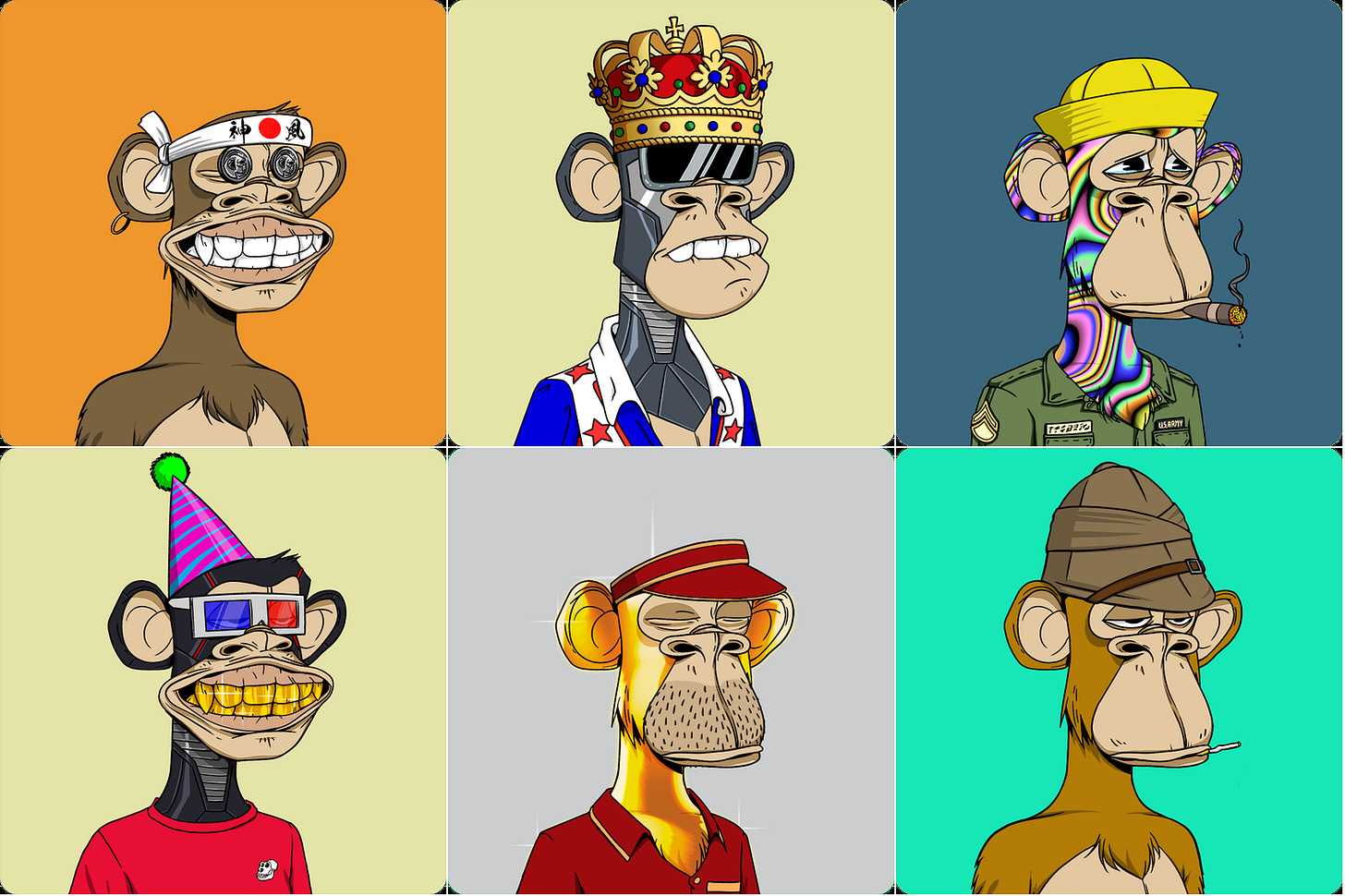

A similar dynamic is shaping up for another early NFT project: the Bored Ape Yacht Club (BAYC). The cartoon apes’ features, similar to CryptoPunks, were fed into an algorithmic program that randomly generates thousands of images with unique combinations of bodies, heads, hats, and clothes. The New Yorker’s Kyle Chayka wrote about this phenomenon in a great piece earlier this summer:

Certain traits—rainbow fur, laser eyes, togas—show up only rarely, making apes that sport those looks more desirable, and thus more valuable. Each image remained hidden until the initial collector paid for it, so buying one was a bit like playing a slot machine—get an ape with the right alignment of traits and you can profit wildly by flipping it.

In this context, the comparisons to prized baseball cards hold weight. A Bored Ape NFT, which could initially be purchased for ~$200 worth of Ethereum, now goes for at least $100k (and upwards of $3m). But there’s more. In addition to being a digital status symbol akin to a fancy watch or pair of rare sneakers, the Ape doubles as your membership to a virtual swamp club. And yes, I know that sounds ridiculous, but it signifies a vital bridge to members-only benefits in the real world. Think access to exclusive events, merchandise, and brand partnerships. Oh, you have a Bored Ape? Here’s 50% off your stay at the MGM Grand.

Here’s another way to think about the implications far beyond BAYC: maybe in the future, if you run the New York City Marathon, you’ll receive a ‘Runners Token’, along with your medal, granting you access to premium runners clubs, discounts on an exclusive pair of Nike’s, and preferred entry to future races. Or maybe you’re a bleeding heart fan of a struggling indie rock band, and buy their tokens to keep them on tour in the early days. If that band makes it big, suddenly those tokens are merits of epic fan cred and will be deeply respected, and valued, by the larger stage community.

Also cool, as Chayka points out, is the way each avatar club is like a strange combination of gated online community, stock-shareholding group, and art-appreciation society. When one ape is bought for a high price, the perceived value of all ten thousand authentic N.F.T.s in the set rises, the same way a painting fetching a record price at auction might increase the value of an artist’s entire catalog.

If you own an Ape or any community-backed-NFT, you have a real stake in the creation of its future:

“It’s taking a gamble on the idea that, in aggregate and over time, the fans might know what’s best for the universe that they care about.” Drew Austin, an early investor, envisioned Bored Ape Yacht Club as a potential “decentralized Disney” of the future...In part, it’s this possibility that makes buying into N.F.T. clubs so desirable: purchasing the hot new avatar might be like acquiring a small fraction of the rights to the next Mickey Mouse.

CryptoPunks and Bored Apes are just two breakthrough examples of NFTs I used to help illustrate the point. Thousands more exist. And it has only just begun. Domain Names, MP4s, articles, and tweets are all starting to be sold as NFTs. This will continue as the market finds its footing. There will be roadblocks along the way, and the get-rich-quick scams will be plentiful, as they’ve always been for industries facing tectonic shifts. That’s why it is so important to educate yourself and understand the culture before making a play. JPEGs are selling for millions as NFTs because they represent a triple threat of social capital, entertainment, and utility. If you aren’t willing to understand this -- if you cannot see the boundless potential -- then you are missing the forest for the trees.

Conclusion

I want to take us back in time to another misunderstood art movement. The year is 1945. Jackson Pollock and his contemporaries, known as the Abstract Expressionists, were baffling the fine art world with shapeless, energetic imagery that defied convention. At the time, these paintings were misunderstood. Many still are. But as time passed, their significance revealed itself. In the immediate aftermath of World War II, the young artists' paintings mirrored a collective psyche. The crisis of war, exposure to human irrationality, genocide, and the devastation of the atomic bomb, were all reflected in abstract depictions.

I think one of the reasons these works are so valuable is because they are timestamps of the human brain reacting to an inflection point in history. The value lies not so much in the art itself, but in the context of how far we had come to arrive at that point, and the possibility of what would follow. Is the movement to Web3 any less significant? I don’t believe it is. When describing the abstract movement in 1945, Surrealist painter Wolfgang Paalen put it in a way that reverberates just as clearly today:

It is no longer the task of art to answer naive questions. Today it has become the role of the painting to look at the spectator and ask:

What do you represent?

Acknowledgments

This essay was largely inspired by the thinking of: